10 Best Stake Coins

The growing popularity of the cryptocurrency industry has led to the emergence of dozens of new digital asset classes in this marketplace. Many of these are highly suitable for those who want to earn passively on their idle crypto-tokens.

Here are some of the best stake coins of 2021 that are offering rewards to their owners.

Tezos is a popular cryptocurrency behind one of the biggest ICO funding campaigns of all time – raising a total of $232 million in July 2017. The stake coin went on to persevere the bear market in 2019 and has performed very well since the turn of 2021. This decentralized application platform has its own native smart contract language called Michelson. This facilitates formal code verification by mathematically proving the properties of the smart contract agreement.

What differentiates this stake coin from other smart contract platforms is that it is entirely securely and managed by Tezos token holders. This is done through the Delegated-Proof-of-Stake (DPoS) mechanism. If you own Tezos, you can delegate your coins to a ‘baker’, who in turn, will validate transactions on your behalf. This has the desired impact of allowing you to earn rewards of around 5-6% per year through Tezos staking.

This makes the digital asset one of the highest-yielding projects amongst the many stake coins in the crypto industry. Apart from being a PoS coin, Tezos also has several other benefits. For example, the platform aims to be completely modular and changeable without needing any hard forks. In other words, this means that the Tezos blockchain can implement new upgrades to the network without having to separate into other chains.

The main advantage of staking Tezos is that you do not have to maintain a node yourself. Instead, you will be delegating your baking rights to the ‘baker.’ Moreover, your Tezos coins will be completely liquid during the staking period. You will be free to move your tokens as there are no freezing periods involved. If you are interested in buying Tezos, then this stake coin is available on Capital.com at 0% commission.

Buy XTZ Now

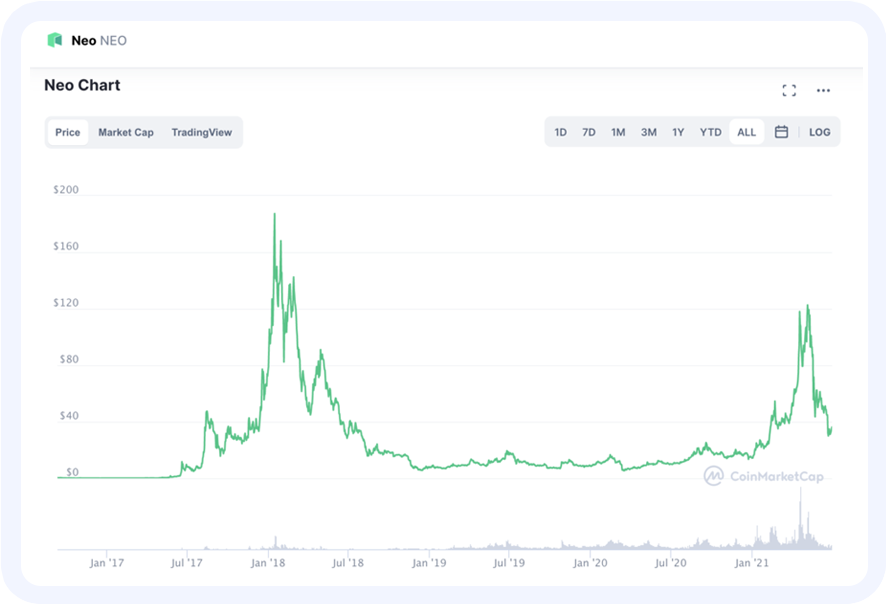

Initially launched in 2016 under the name Anti-Shares, NEO is a blockchain platform built for creating digitized assets and smart contracts. Following a bear market in the two years prior, the value of NEO has enjoyed a very successful start to 2021. As this, NEO is one of the best stake coins to consider – should you be looking to invest in a digital asset that has a lot of bullish sentiment surrounding it

In order to create a more secure digital economy, this stake coin platform issues and handles two crypto coins – the NEO token and the GAS token. When you hold NEO, it gives you access to two main features. The first function is the right to vote in the elections – which determines Neo Council members.

The second and the more significant function is your right to claim GAS tokens. For those unaware, all transaction fees on the NEO network are paid in GAS and the number of tokens you can earn is directly proportional to the amount of NEO you own. Once you have sufficient GAS in your portfolio, you can exchange them for another cryptocurrency or use them to access the NEO blockchain.

In order to start earning GAS tokens and thus – staking rewards, you can purchase NEO coins from a cryptocurrency broker. Alternatively, if you are looking to speculate on the future value of this top-rated stake coin – then you can do so at Capital.com without paying any commission. If opting for the former, this will automatically give you access to GAS tokens that are then available for you to claim.

Buy NEO Now

At its fundamental level, the Cosmos network is a collection of cryptocurrency blockchains. Instead of using bridges like other systems, this top-rated stake coin uses ‘Hubs’ for connectivity between one blockchain to another. These Hubs are individual blockchains that function as a single point that different blockchains can connect to for interoperability with other connected networks.

The Cosmos blockchain is one of many Hubs available on its native protocol. ATOM is the native digital token of this staking network. Although ATOM coins are limited to staking on the Cosmos blockchain, they are used to govern the entire network of the same name. Similar to Tezos, you can delegate your tokens to validators and earn passive income by participating in the Cosmos protocol.

The annual returns on staking Cosmos amounts to 8 to 10% – but this will also include the validators’ fee. Therefore, you will need to carefully select your validator because the stake coin rewards you receive will ultimately depend on them. Only those within the top 125 have the permission to distribute rewards to ATOM holders. If you think that the value of Cosmos is likely to rise in the future – you can trade ATOM commission-free at Capital.com.

Buy ATOM Now

Cardano has consistently ranked among the top 20 cryptocurrencies by market cap. Its native alt token – ADA, is also one of the leading contenders for being one of the best stake coins available in the crypto sector. The digital asset was conceptualized in 2015 by Charles Hoskinson, who also happens to be one of the co-founders of Ethereum. Similar to Ethereum, Cardano features smart contracts, which essentially allow all kinds of applications to be built on the network.

However, this blockchain differentiates itself from others in this space through peer-reviewed academic research that delves deep into its future development. In other words, before a new upgrade is released, the developers submit the papers to major cryptocurrency platforms and get their research validated by independent experts. And consequently, Cardano is the first ‘provably’ secure Proof-of-Stake protocol.

As a stake coin platform, Cardano also makes it possible for others to launch new cryptocurrencies with corresponding tokens on the network. ADA is Cardano’s governance token and the driving force behind the entire blockchain framework. Furthermore, owning this top-rated stake coin will allow you to take part in the Cardano project.

As Cardano runs on a Proof-of-Stake protocol, this enables you to stake your ADA coins and subsequently earn rewards that help to secure its ecosystem. You can make passive income of up to 6% per year simply by holding ADA tokens in your wallet. Alternatively, if you simply want to speculate on the value of this stake coin with leverage, you can buy Cardano from Capital.com on a commission-free basis.

Buy ADA Now

Kava.io is a cross-chain DeFi platform that offers lending services to cryptocurrency owners. You can leverage your crypto assets against loans by collateralizing them through KAVA’s smart contracts. The platform intends to open up liquidity and accessibility to crypto enthusiasts around the world and thus – this makes KAVA one of the best stake coins to consider for your investment portfolio in 2021.

KAVA achieves this goal by providing open access to crypto loans via stablecoin USDX – which is pegged to the US dollar. Furthermore, the main aim of the Kava.io protocol is to extend the capabilities of the DeFi landscape that are enjoyed by Ethereum to other blockchains. This top-rated stake coin platform also allows you to earn KAVA tokens in return by minting USDX stablecoins.

Once minted, these digital assets can be contributed to the money market of KAVA – called the HARD protocol. For those who are not eager to mint USDX, you also have the option to stake KAVA – the governance token of the Kava.io protocol. You can delegate your coins to a validator and earn direct KAVA rewards from the network. This promotes a stable way to increase the value of your investment.

However, eligibility for this is reserved only for the top 100 Kava validators. Alternatively, as a KAVA holder, you can also stake your tokens on a number of cryptocurrency exchanges – like Binance and Huobi. Or, it is also possible to stake KAVA through crypto-wallets. If you are looking to buy KAVA to profit from the stake coin’s rise in value, you can do that through a regulated crypto broker like Capital.com.

Buy KAVA Now

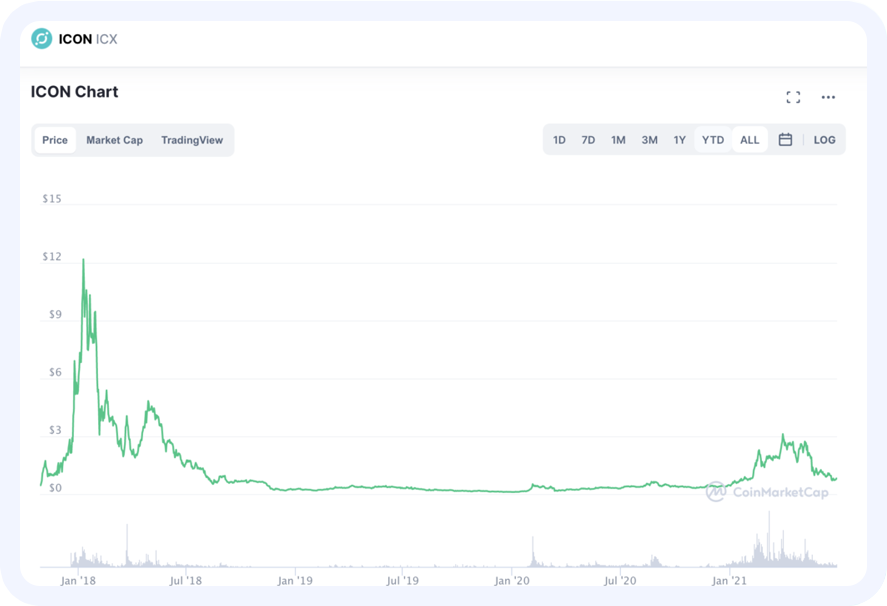

Icon is another top-rated stake coin that was launched into the cryptocurrency market in late 2017. After its initial price hike in the first few months of 2018, the value of this stake coin has remained somewhat stable. The Icon protocol makes way for different independent blockchains to communicate with each other. Fundamentally, the Icon project uses a smart contract system with different nodes and communities that make up the network.

ICX is the stake coin that was developed for the Icon network. This stake coin can be used to make payments on the protocol, or create new smart contracts. However, Icon’s key advantage is its utility in calculating the rate between two digital assets. This is a major advantage for those seeking clarity in an ever-changing cryptocurrency trading landscape that is overly volatile at times.

The different utilities of Icon for enabling communication between multiple blockchains give it an edge over other coins such as Ethereum or NEO. In addition, there are several potential use cases of the Icon network – that range from payment transactions, cross-border information sharing for healthcare services, anonymous voting, and more. Most importantly, instead of being mined, you can buy ICX from major cryptocurrency platforms such as Capital.com.

Every ICON holder has the option to stake his or her ICX tokens – to earn rewards in return. According to Icon, you as a staker will receive three votes for each token held. This will give you voting rights for policies regarding Representative Nodes, expansion programs, and the development of dApps. These votes can also secure you an annual reward of between 2 to 12%. This means, for three votes – you will get a total reward of between 6 to 36%.

Buy iCX Now

Launched in 2016, Polkadot is the brainchild of Gavin Woods, a co-founder of the Ethereum network. In its most basic form, it is a platform that facilitates interoperability between multiple chains. In fact, Polkadot is the pioneer in the crypto industry that made it possible for blockchains to interact with each other. Polkadot allows any blockchain – be it private or public, permissioned or permissionless, to connect to each other in a trustless manner.

Put otherwise, Polkadot allows multiple blockchains to transfer data in a trustless fashion through a single secure channel – and enables them to share their distinct features. The network is run by the Web3 Foundation and intends to become the next-generation blockchain with a fully scalable ecosystem. If it is able to achieve this goal on a mass scale, Polkadot could be one of the best stake coins to buy this year.

Given these applications of the Polkadot network, it is not surprising that there is an increasing interest in investing in its government token, DOT. Moreover, as a DOT owner, you can earn additional rewards by staking your coins instead of merely storing them in a private wallet. If you want to stake DOT, you can do this by either becoming a validator yourself or nominating another individual for this role.

Polkadot validators offer an average return of 10% – making it one of the best stake coins in the market. However, note that this will vary depending on the amount you stake, the number of validators, and the commissions they charge. For those who want to buy Polkadot to profit from its long-term value potential, DOT coins are available for purchase from popular online crypto brokers like Capital.com.

Buy DOT Now

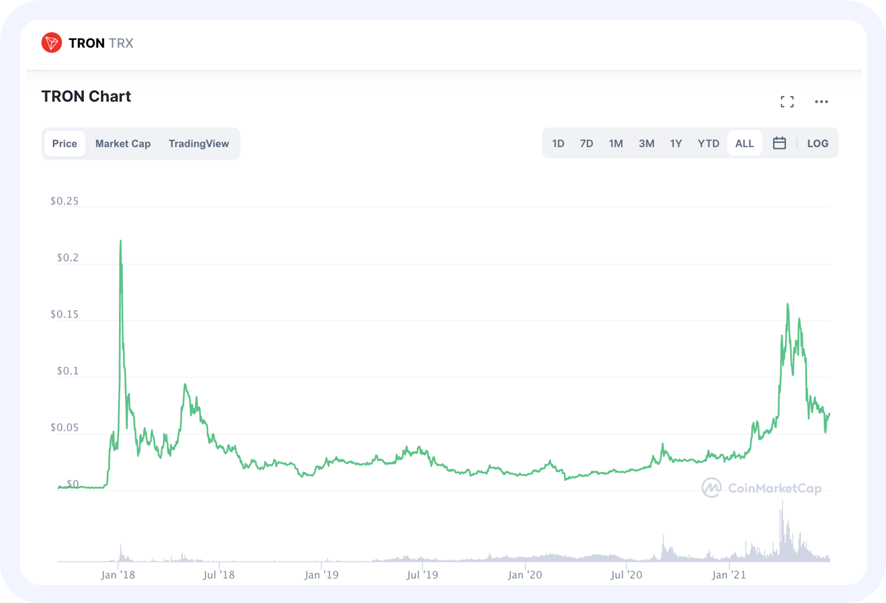

TRON was developed in 2015 by a Singapore-based non-profit organization called the TRON Foundation. The network was designed to be a data-sharing blockchain platform that relies on peer-to-peer networking. The main objective of the TRON Foundation is to make the internet more decentralized, particularly in terms of how users approach content. The platform does this by eliminating the middleman between content creators and consumers.

Furthermore, this is also achieved by removing the need for unnecessary intermediaries. This way, the TRON project has the potential to be of use to social networks, gambling sites, online gaming, and other digital recreation centers. The TRON coin, with the ticker symbol TRX, is designed to be a universal token that has utility across different platforms, especially in the gaming sector.

The TRON network and its underlying stake coin aim to create a global digital entertaining system where content can be shared freely in a less-expensive means. Those holding TRON can stake their coins to receive additional rewards and voting rights on the protocol. The annual return on TRX is approximately 7%, minus the validator commission. This offers a great way to increase your TRX coins over the course of time in a truly passive manner.

On the TRON network, validators are called ‘Super Representatives’. The rewards you receive will depend on your chosen SR and the fee that they charge. You will be able to manually claim your returns every 24 hours, or wait until the coins are reflected in your wallet, depending on your SR. This top-rated stake coin is available to purchase from over 130 cryptocurrency providers – including 0% commission platform Capital.com.

Buy TRX Now

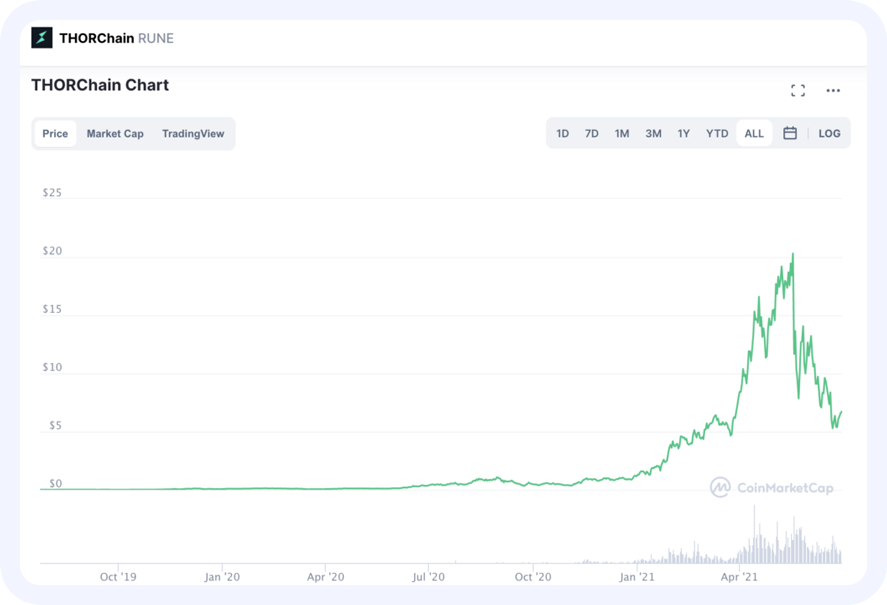

THORChain was developed in 2018 by a pseudonymous team of crypto developers at a Binance Hackathon. As such, there is no founder to this coin per-say, so none of the developers have any specific titles. Most notably, unlike other prominent cryptocurrencies, many of THORChain’s resources were developed by its community members. This makes THORChain one of the most unique decentralized platforms of today.

This, among many other reasons, is why some commentators believe that THORChain has the potential to become one of the best stake coins to hold over the coming years. In terms of its pseudonymous set-up, THORChain uses this characteristic to its advantage by being fully transparent about its core operations. Each and every developmental update and treasury report is published on Medium on a regular basis.

In terms of its functionality, THORChain is a protocol that makes it possible to instantly exchange cryptocurrencies between blockchains. It is designed to function as the backend network for the next generation of digital asset exchanges. The platform’s native stake coin RUNE was launched in 2019. The network is designed in such a way that, at any given moment, THORChain validators must be staking a certain amount of RUNE.

This amounts to a figure that is double the worth of the total value locked by liquidity providers. It is important to note that on THORChain, you can earn returns by staking your coins or by being a liquidity provider. Stakers earn fees through block rewards, without being exposed to wider market volatility. On the other hand, liquidity providers make returns from fees, which will be proportional to their stake.

Buy RUNE Now

Launched in 2016, VeChain was created by Sunny Lou – the former CIO of Louis Vuitton. He combined his understanding of blockchain technology and expertise with supply chain management to come up with VeChain as a trackability product in the luxury and fashion sector. As an ecosystem, VeChain can be used by business owners to obtain a complete overview of what happens to their product as it makes its way through different channels.

The blockchain of the VeChain network – called the VeChain Thor, relies on two digital assets to operate the ecosystem – the VeChain (VET) and VeThor (VTHO). While VET functions like any other cryptocurrency, VTHO coins are referred to as the energy token of the blockchain – used as gas to cover the computational costs. Staking VET will get you rewards in terms of VTHO. You can stake VET by setting up your own nodes as a validator or by being a nominator.

If you choose to set up your own node, it will require you to put up a minimum amount of VET – which can be quite large for many people. As such, the alternative is to stake via a third-party platform and delegate your VET coins. Currently, the estimated returns for staking VeChain is around 1 to 2%. In a nutshell, when you stake these tokens, you get more digital assets in return. You can buy VET tokens without paying any commission on Capital.com.

Title for Advertisement

Lorem ipsum dolor sit amet, consectetur adipisicing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit cupidatat.

in voluptate velit esse cillum dolore eu fugiat nulla pariatur. Excepteur sint occaecat non proident, sunt in culpa.

Start Trading

How to Stake Your Digital Tokens?

As we discussed earlier, there are two approaches that you can take towards staking. The standard method will require you to be a validator, allowing you to lock your coins into a smart contract. Alternatively, staking platforms also allow you to delegate your voting rights to ‘validators’ and earn income passively.

- In this case, your chosen validator will earn the rewards for blockchain validation and will, in turn, pay you for supporting them.

- With this in mind, most cryptocurrency stakers choose to go for the second option.

- This will require a relatively lower investment in terms of the number of stake coins and technical knowledge.

As such, we will introduce you to the best staking platforms that you can use to start earning passive income with your digital tokens.

Best Staking Platforms 2021

Full Reviews

Choosing the best staking platform can be decisive of what returns you will actually be able to earn from your digital assets. In the staking coin arena, there are three different types of services you can use. Let us take a close look at each of these in great detail.

Staking-as-a-Service Platforms

Staking-as-a-Service providers essentially work as the middleman. These systems run the nodes for Proof-of-Stake protocols on behalf of investors and allow you to stake your coins without having to perform the validation yourself. This is option is therefore ideal for those wishing to take a hands-off approach.

Learn More

Cryptocurrency Exchanges

Cryptocurrency exchanges can function as an all-in-solution for those who want to purchase their digital tokens and stake them with ease – all without leaving the platform.

Learn More

Private Wallets

When it comes to staking through wallets, you have the option to choose a hot wallet or a cold wallet. In comparison, cold wallets are considered more secure as these are not always online. In cold staking, you will be holding your coins in the same address – as moving them will break the locking period and will lead to you losing the rewards.

Learn More

DeFi Staking

DeFi staking is another term that you will come across when learning about how to buy the best stake coins. At this stage, it is best that you know the difference between centralized and decentralized platforms. Decentralized Finance or DeFi has been gaining a lot of popularity as an emerging sector. As a result, there have been several DeFi protocols launching new tokens into the cryptocurrency marketplace.

Learn More

Staking-as-a-Service Platforms

Let’s let at some of the best staking platforms active in this sector:

01

Figment Networks

Created in 2019, Figment Networks is a top-rated blockchain infrastructure and staking provider based in Canada. The platform allows you to stake over 20 protocols effortlessly, including Cosmos, ICON, Kava, and others. Figment Networks claims to be the pioneer in offering legal and compliant token staking services on the internet. The platform is established in the software development space, with over 30 years of experience developing internet infrastructure.

As an all-in-one staking provider, Figment Networks enables you to not only stake your digital tokens but also participate in blockchain governance and build applications. In terms of crypto staking, Figment Networks integrates Web 3 protocols complemented by round-the-clock customer support. The infrastructure is partnered with a number of private and public sentry nodes on a variety of Cloud solutions.

02

MyContainer

MyContainer is one of the most popular staking service providers in the cryptocurrency industry. It has combined impressive features and great reward products in order to attract more investors. The platform is based in Estonia and was first established in 2018. Over the years, MyContainer has emerged to become the safest and easiest means to stake coins with high rewards.

MyContainer supports over 100 cryptocurrencies – inclusive of Polkadot, Ethereum 2.0, Tezos, Cosmos, and more. The best feature of this platform is that you can stake and earn rewards on multiple coins simultaneously. For those interested, the service also offers support for advanced automatic masternode staking for selected digital tokens. Another advantage of using MyContainer is the ease of staking on this platform.

03

Staked

Staked is another popular Staking-as-a-Service provider that is based in New York. The platform currently features over 30 stake coins – namely, Ethereum 2.0. Polkadot, Cardano, Kava, and many more. The annual rewards on staked coins range from 5 to 27%. Staked.us distinguishes itself by using an automatic smart contract system named Robo Advisor for Yield (RAY).

This mechanism is utilized to provide investors with information regarding the staking coin infrastructure to earn the best possible rewards depending on their risk profile. The fees charged on the platform typically range between 5 to 10% – based on which coin you are staking.

Cryptocurrency Exchanges

Here is a list of some of the most popular cryptocurrency exchanges offering staking services.

01

Binance

Binance is arguably the most popular cryptocurrency exchange of today. Among its many services, the platform also offers three types of crypto staking – Locked Staking, Flexible Staking, and DeFi Staking. If you choose Locked Staking, then you will have to lock your assets for a period of between seven to 90 days. This will get you staking rewards in the range of 2.8% to 16% per annum.

On the other hand, the Binance Flexible Staking option is designed for those of you that want to earn rewards without locking your currencies away. However, as you can imagine – this will yield you smaller returns in comparison to a locked plan.

02

Coinbase Custody

Coinbase is another cryptocurrency exchange that is a favorite among crypto investors and traders. The provider features both a trading platform and a wallet, along with providing extensive educational resources and an automated investing feature for crypto traders across all levels.

In 2018, the platform launched Coinbase Custody – its standalone custodial service that facilitates the staking of cryptocurrencies. The platform is, in fact, the first crypto-custodian to offer active governance of digital coins that are stored online. In other words, Coinbase makes it possible for those who hold their digital assets in offline wallets and still stake their tokens.

03

Kraken

Kraken is another cryptocurrency platform that allows you to maximize returns on your crypto assets by staking them. The company is a San Francisco-based crypto exchange that was founded in 2011. Kraken later introduced its staking service to its set of features and has facilitated over 1 billion dollars worth of transactions.

The most noticeable feature of staking on Kraken is that there is no minimum locking time required to start earning rewards. As such, you can start earning returns right away. And most importantly, there are no associated staking fees. However, Kraken will retain an admin fee for staking a few coins such as Ethereum – due to the extent of complexity involved.

04

Poloniex

If you want to stake your digital coins through a cryptocurrency exchange, Poloniex is another viable option that is worth considering. However, the main issue here is that you will be able to stake only four tokens – namely, Cosmos, TRON, BitTorrent, and Wink.

That said, Poloniex offers plenty of flexibility when it comes to staking. There is no opt-in required and no lock-up period on your digital assets. You will also have the freedom to make a deposit, trade your tokens, or withdraw them at any given point. There are also no staking fees except for Cosmos, which is relatively high at 25%.

Private Wallets

If you prefer this approach to staking, here are the best platforms that allow you to do so.

01

Ledger

Ledger is perhaps one of the most popular cold wallets available in the crypto industry. The main benefit of using such a wallet is that you will be in full control of your coins while staking – as it remains offline at all times other than when you seek to transfer funds Currently, Ledger hardware wallets support staking for up to several digital tokens at a time – which includes the likes of Tezos, TRON, Cosmos, Polkadot, and Algorand.

On Ledger, there are three ways for you to earn returns by staking. You can either claim your rewards by simply storing your wallets – where how much you earn will be determined by the number of coins and the rate decided by the protocol. You can also delegate a part of your stake to a validator, who will then share some of their revenue with you. Alternatively, you can also become a validator and run your own node to receive direct rewards.

02

Trezor

Trezor is another cold wallet that supports staking. However, you cannot do this directly from its interface. Rather, you will have to link it to a staking pool through another middleman such as AllNodes or JunoStakePool. These are automated scripts, albeit, setting up a stake from your hardware Trezor wallet will not take much time.

You can also set up either a pooled stake or a dedicated node from your wallet. An additional perk of Trezor is that you can also use the Exodus wallet as an interface. Your stake coins will then go through the Exodus app to collect staking income.

03

Exodus

If you are looking to stake your coins in one of the simplest ways, then Exodus can be a viable option for you. The advantage here is that Exodus is a completely free and user-friendly wallet. However, it is a hot wallet – which might add more to the risks involved.

The digital wallet supports over 130 assets through its app, and staking is allowed for seven PoS tokens through the desktop version. Most importantly, staking through Exodus requires no technical knowledge at all. Some assets automatically collect rewards, while for others, you will have to activate staking by yourself. hassle.

DeFi Staking

All the staking platforms that we have mentioned above are centralized entities. Unlike CeFi (Centralized Finance), DeFi provides users with decentralized financial services through smart contracts that are built on top of the blockchain protocol. However, when you hear the term DeFi staking – you need to understand how this differs from the general idea of stake coins.

DeFi staking is primarily known as ‘Liquidity Mining’ or ‘Yield Farming’. Instead of delegating your assets to a validator, in this process – you will be contributing towards the liquidity on DeFi protocols. The more liquidity you provide, the more rewards you will earn. The assets you provide will be aggregated and used for other features such as crypto loans.

In DeFi staking, you will be investing directly in decentralized protocols or on centralized exchanges that provide pool staking services – such as Binance.

If you are using a DeFi platform, you will be relying on smart contracts to contribute to liquidity pools and earn commissions.

There are several DeFi tokens that are commonly used for staking – such as Uniswap (UNI), Maker (MAKER), and Synthetic (SNX).

You will also come across platforms that allow you to find the best staking coins and rewards across multiple protocols. As such, when you are considering your options for staking coins, you will further have a choice between centralized and decentralized systems. Now that you know which are the best staking coins in 2021 and which platforms you can use to grow your digital assets – let us take a closer look at the concept of staking.

Bottom Line

Choosing the best stake coins will require you to make several core considerations – inclusive of market analysis, risk tolerance, and your personal preferences. Regardless, when you decide to begin staking, it will be best to start by experimenting with smaller amounts.

Always remember to select a staking project that resonates with you and one that you believe will be around far into the future. After all, ultimately – by staking, you will be helping to help the respective crypto network become a success.

If you are looking for a crypto platform to buy the best stake coins – then we would suggest you do so with a regulated and trusted platform. Capital.com, for example, is home to over 130+ digital assets – including all of the 10 best stake coins we discussed on this page. Plus, not only can you buy and sell commission-free – but also apply leverage!

Want to start staking right now?

@StakeMoonOfficial

@StakeMoonOfficial